Introduction to Wyckoff Theory and its Application to Financial Markets

Wyckoff theory is a trading method that was developed by Richard D. Wyckoff in the early 20th century. It is based on the principle that the movement of the markets is the result of the actions of large institutional investors and market makers. Wyckoff believed that by understanding the motivations and behavior of these market participants, traders could anticipate market movements and make profitable trades.

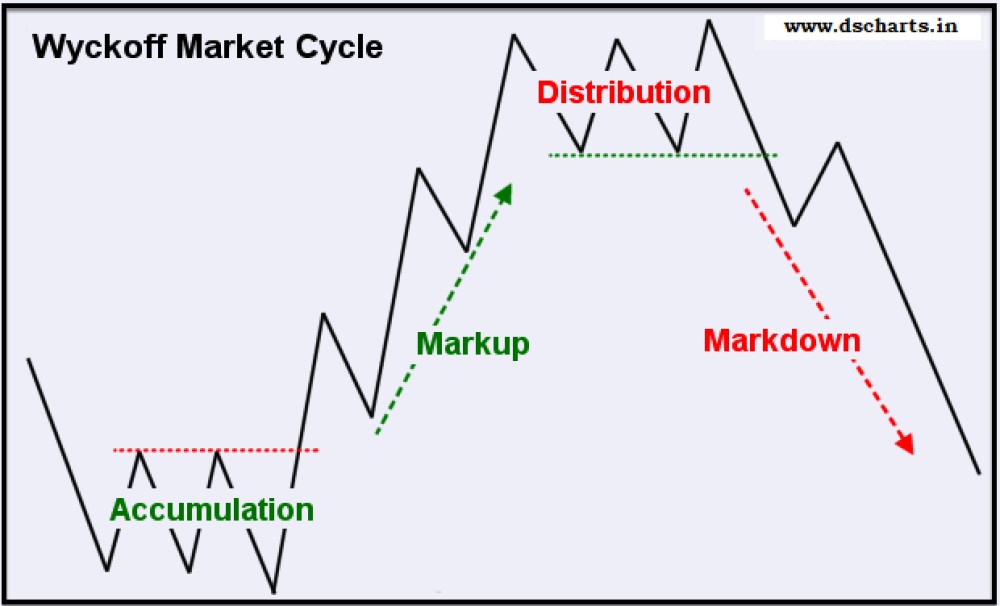

The Wyckoff method is a technical analysis approach that uses price and volume analysis to identify trends and trading opportunities. It is based on the idea that the market moves in cycles, with each cycle consisting of four phases: accumulation, markup, distribution, and markdown. These phases are characterized by specific price and volume patterns that traders can use to identify the current phase of the market cycle.

In the accumulation phase, smart money investors buy assets at lower prices, often accumulating large positions without attracting attention. The markup phase follows, characterized by a steady rise in price with increasing volume, driven by demand from smaller investors entering the market. In the distribution phase, smart money investors sell their assets to less informed market participants, creating a market top. Finally, in the markdown phase, prices decline as supply outstrips demand.

Wyckoff theory has several applications to financial markets. Traders can use Wyckoff analysis to identify trends, support and resistance levels, and potential market turning points. By understanding the psychology and behavior of market participants, traders can develop strategies for buying and selling assets, including entry and exit points, stop-loss orders, and profit-taking targets.

Wyckoff theory can be applied to a wide range of financial markets, including stocks, bonds, commodities, and currencies. Traders can use Wyckoff analysis to trade on a variety of timeframes, from intraday trading to long-term investing. However, like any trading method, Wyckoff theory has limitations and requires careful analysis and risk management to be successful.