Investor Psychology in Candlesticks

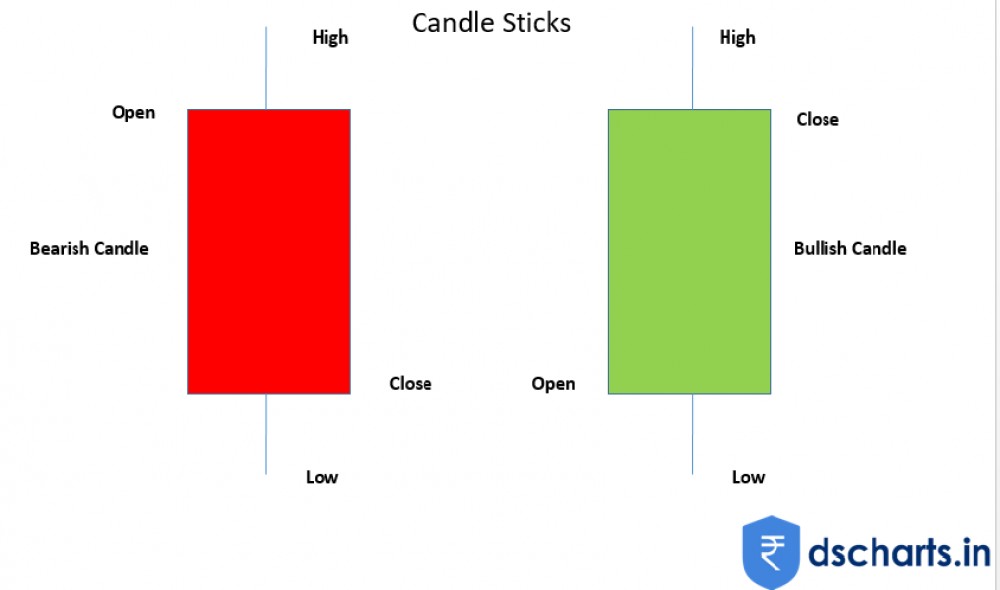

Candlesticks Anatomy

We will start the Technical analysis Course with the basic concepts of Candlesticks. what are Candlesticks? Why is it important? How to trade using Candlesticks? We define Candlesticks with different names based on the size of the Body and length of the Tail.

Candlesticks Patterns

Candlesticks patterns foam because of trader behavior in the process of investing or trading in any Financial Instruments. As per History these Patterns constantly repeat. We can understand the psychology of the trader or investor with these patterns

The Market Structure.

Very important to become a professional trader, Types of markets as per investor Behaviour 1.Bear Market, 2.Bull Market, 3.Consolidation or sideways.

Importantly we have to understand the Support and Resistance zones, Trend lines, etc.

Time frames and top-down analysis.

Understing Multi time frames in the Stock market is very very important. Because markets are dynamics it changes timely according to Investor Psychology. Trading strategies and tactics In price action we use Pin bar Strategy, Engulfing bar Strategy, etc.

Money Management or Risk Management

It is very important to the session to manage your capital to minimize your risk and maximize your profits.